ETH Price Prediction: Analyzing the Path to New All-Time Highs in 2025

#ETH

- Technical Strength: Price above 20-day MA with improving MACD momentum suggests continued bullish bias

- Institutional Activity: Mixed signals with ETF outflows but substantial whale accumulation and treasury purchases

- Fundamental Developments: Security project advancements and ecosystem growth providing strong underlying support

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

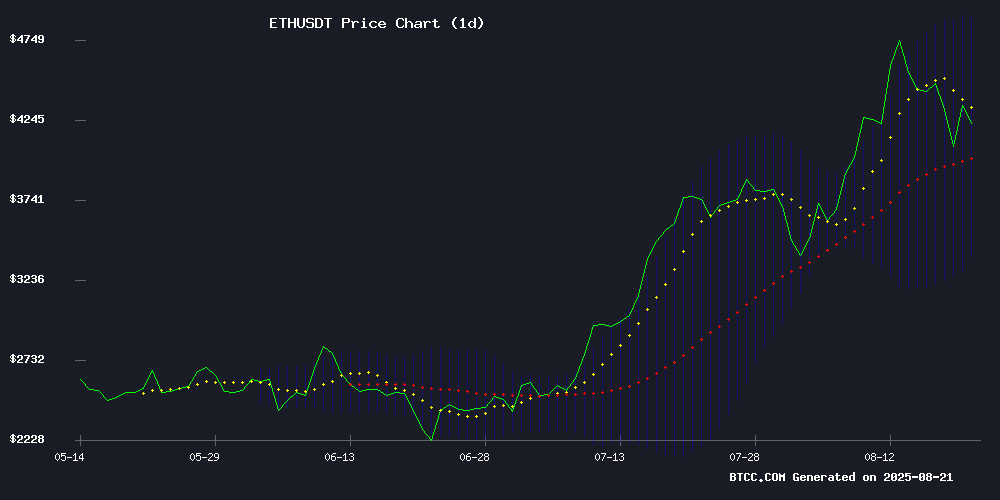

ETH is currently trading at $4,284.14, comfortably above its 20-day moving average of $4,139.53, indicating sustained bullish momentum. The MACD reading of -399.17, while negative, shows improving momentum with the histogram at -58.16. Bollinger Bands position the price NEAR the upper band at $4,894.44, suggesting potential resistance ahead. According to BTCC financial analyst Ava, 'The technical setup supports further upside, with the $4,139 level acting as crucial support. A break above $4,900 could trigger the next leg higher.'

Market Sentiment: Institutional Moves and Security Developments Drive Optimism

Market sentiment remains cautiously optimistic despite recent ETF outflows. Major developments include Ethereum's trillion-dollar security project entering phase two and significant whale activity, including a $282 million long position. BTCC financial analyst Ava notes, 'While institutional players are showing some retreat through ETFs, the underlying fundamentals remain strong with major security upgrades and substantial whale accumulation. The $667 million treasury purchase by SharpLink Gaming and the CME gap fill are particularly bullish signals for medium-term price action.'

Factors Influencing ETH's Price

Ethereum's Trillion Dollar Security Project Enters Phase Two

Ethereum has advanced to the second phase of its Trillion Dollar Security initiative, targeting critical user experience and wallet security enhancements. The Ethereum Foundation identified these priorities through a comprehensive ecosystem survey, signaling a strategic push to bolster both individual and institutional adoption.

A "Minimum Security Standard" for Ethereum wallets will anchor the initiative, establishing clear benchmarks for key management and transaction signing. This framework aims to reduce vulnerabilities while maintaining Ethereum's decentralized ethos—a delicate balance that could redefine secure blockchain interaction.

Ethereum Whale Places $282 Million Long Position as ETH Nears All-Time High

A significant Ethereum whale has made a bold $282 million long bet on ETH through Hyperliquid, signaling strong confidence in the cryptocurrency's upward trajectory. The whale, identified by address 0x2eA, set liquidation levels between $3,699 and $3,732, suggesting a belief that recent price dips may have bottomed out.

Ethereum currently trades at $4,356, firmly above critical support levels at $4,000 and $3,700. Market analysts observe growing momentum that could propel ETH beyond its previous all-time high, fueled by institutional interest and whale activity.

The third quarter of 2025 is shaping up to be one of Ethereum's strongest periods, with price action remaining resilient despite broader market volatility. This whale's massive position underscores the bullish sentiment surrounding ETH's near-term prospects.

Optimiums and the ‘L2’: Ethereum Security Revisited

The definition of Ethereum layer-2 solutions is under scrutiny as the line between true L2s and "Optimiums" blurs. While traditional rollups like those using Ethereum for data availability (DA) maintain permissionless state reconstruction, Optimiums outsource DA to external networks like EigenDA or Celestia, introducing additional trust assumptions.

Toghrul Maharramov, a rollup researcher, argues vehemently that Optimiums should not be classified as L2s, calling attempts to label them as such a "psyop." This debate gained traction with Celo’s transition from an L1 to an L2, despite its reliance on off-chain DA solutions.

Vitalik Buterin’s liberal use of "L2" to describe such chains adds complexity to the discussion. The distinction isn’t merely semantic—it speaks to the core of Ethereum’s security model and the trade-offs in scaling solutions.

Ethereum (ETH) Price Prediction: Institutional Accumulation Amid Retail Caution

Ethereum dipped to a two-week low near $4,201, down 2.53%, as retail traders turned cautious. Institutional players tell a different story—Bitmine's $220M ETH accumulation signals long-term confidence despite short-term volatility.

CME Ether Futures reveal a stark divide: hedge fund shorts surged to $4.19B, dwarfing asset managers' $1.22B long positions. The pressure intensified as U.S. Ethereum spot ETFs bled $197M in daily outflows, their second-worst day on record.

Validator exits loom large, with 910,000 ETH ($3.9B) queued for unstaking. Timothy Misir of BRN flags $4,400 as a critical threshold: "A decisive break below could trigger accelerated downside."

OpenServ Appoints Joey Kheireddine as Head of Blockchain to Accelerate Onchain Roadmap

OpenServ, a leading full-stack AI app-building infrastructure in Web3, has named Joey Kheireddine as its new Head of Blockchain. Kheireddine joins from Eliza Labs, where he served as Head of Engineering, bringing extensive experience in agentic AI and crypto to drive OpenServ's onchain initiatives.

"OpenServ is doubling down on people who ship," said Tim Hafner, CEO of OpenServ. Kheireddine's track record includes deploying decentralized applications such as wallets, block explorers, and NFT contracts, handling over 70,000 ETH in combined marketplace volume.

"My mandate is simple: ship faster, harden the stack, and make building on OpenServ the easiest path for teams launching AI-powered apps," Kheireddine stated. His prior work at Eliza Labs included developing AI-driven token launchpads, underscoring his expertise at the intersection of AI and blockchain.

SharpLink Gaming Expands Ethereum Treasury With $667M Purchase

SharpLink Gaming has fortified its position as a major corporate holder of Ethereum with a $667 million acquisition. The sports betting technology firm added 143,593 ETH at an average price of $4,648, bringing its total holdings to 740,760 ETH—valued at approximately $3.2 billion.

The purchase was funded through $537 million in net proceeds, including $390 million from a registered direct offering and $146.5 million from its at-the-market program. An additional $84 million in cash reserves remains earmarked for future acquisitions.

Beyond accumulation, SharpLink is actively generating yield through Ethereum's proof-of-stake network, earning 1,388 ETH in staking rewards. Nearly all of its holdings are deployed in liquid staking protocols, though regulatory uncertainties around U.S. oversight of staking services pose potential risks.

The aggressive expansion comes despite a $103 million net loss reported in the second quarter, underscoring the company's high-conviction bet on Ethereum's long-term value.

Why Ethereum Price May Hold $4,000 Despite Big Player Dump Rumors

Ethereum's price dipped below $4,140 this week, marking a 9.5% decline over seven days. While selling pressure mounts, underlying data suggests the correction may be nearing its end rather than signaling a prolonged downturn.

Speculation points to Binance as a potential driver of the sell-off, with on-chain analysts noting coordinated withdrawals preceding each price drop. The exchange appears to be targeting leveraged long positions, with $4,030 emerging as a key liquidation threshold. Wallet tracking reveals telltale patterns of institutional-sized movements timed to market movements.

Contrary to surface-level panic, the Chaikin Money Flow indicator reveals underlying accumulation. 'Smart money appears to be using this dip strategically,' notes one trader monitoring whale wallets. The $4,000 level now serves as both technical support and psychological battleground.

ETH ETFs See Massive Outflows as Institutional Players Retreat

Ethereum's market momentum has reversed sharply, with institutional investors leading a $422 million single-day exodus from ETH ETFs. The sell-off marks a stark contrast to recent weeks of steady inflows, as the asset struggles to maintain footing above $4,200.

BlackRock, Fidelity, and Grayscale collectively dumped $160 million worth of ETH holdings, triggering the second-largest daily outflow since the funds' launch. On-chain data reveals no corresponding buying pressure, creating a liquidity vacuum that's pushed prices down 10% weekly.

The retreat comes as ETH fails to retest its $4,878 all-time high. Market observers note this cooling period follows last week's record inflows, suggesting institutions may be rebalancing rather than abandoning crypto exposure entirely.

Ethereum-Based Meme Coin Pepescapes Raises $1.2M in Presale Funding

Pepescapes, an Ethereum-based meme coin, has secured $1.2 million in its presale phase, marking a significant milestone for the project. The strong investor demand positions it as one of the most anticipated meme coins of 2025, with each presale stage attracting growing participation.

The project distinguishes itself by blending meme culture with tangible utility, appealing to both casual traders and serious crypto investors. Its community-driven approach—fueled by social media engagement, AMAs, and transparent updates—has fostered a loyal following.

Trust remains central to Pepescapes' strategy, underscored by partnerships with Gigacex and Coinsult. The team is developing a proprietary exchange to ensure security, usability, and alignment with long-term goals.

Ethereum Whale Bets $16.35M on Rebound Despite Recent Dip

Ethereum (ETH) slid more than 4% in 24 hours, trading near $4,150, yet whales are doubling down. A high-stakes $16.35 million leveraged long position at $4,229.83 per ETH signals conviction in an imminent rebound. The trade, amplified by 25x leverage, risks liquidation below $4,046 but targets a squeeze of clustered shorts between $4,300-$4,360.

Two other whales deployed $262 million combined during the dip, reinforcing bullish sentiment. Market mechanics suggest upward pressure could mount as overleveraged shorts cover positions. Ethereum's price action now hinges on whether support near $4,100 holds against mounting volatility.

Ethereum Fills the CME Gap—Could This Ignite the AltSeason 2025?

Ethereum is demonstrating resilience as Bitcoin consolidates, with ETH holding key support levels despite broader market caution. The cryptocurrency has filled its CME gap—a technical event often preceding stronger price action—after rallying back to $3,250, a level previously left open on CME futures. Traders are watching closely, as historical data shows over 80% of such gaps tend to close within weeks.

Currently trading near $3,280, Ethereum maintains support above its 20-day EMA at $3,220, with the 200-day EMA providing a stronger floor at $2,950. The RSI at 58 suggests building bullish momentum. This development raises questions about whether ETH's move could catalyze the next altseason, particularly as other altcoins begin showing signs of life.

How High Will ETH Price Go?

Based on current technical indicators and market developments, ETH appears poised for further upside movement. The combination of strong technical support at $4,139, ongoing institutional accumulation despite ETF outflows, and major ecosystem developments creates a favorable environment for price appreciation.

| Target Level | Probability | Key Drivers |

|---|---|---|

| $4,500-$4,700 | High | Technical breakout, whale accumulation |

| $4,900-$5,200 | Medium | Security project completion, institutional FOMO |

| $5,500+ | Low | Full altseason momentum, major adoption news |

BTCC financial analyst Ava suggests, 'The convergence of technical strength and fundamental developments could propel ETH toward the $4,900 resistance level in the coming weeks, with potential for new all-time highs if broader market conditions remain supportive.'